Overview of Japanese Tax

The common Japanese taxes for companies and individuals are as follows:

Companies

- Corporate tax (national tax)

- Business tax (local tax)

- Prefectural and municipal inhabitant taxes (local tax)

- Consumption tax (national tax)

- Depreciable asset tax (local tax)

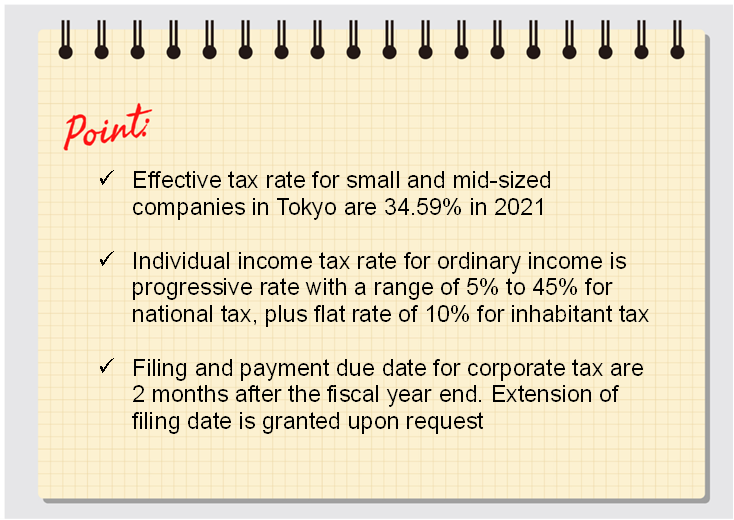

Effective tax rate in Tokyo for a company with stated capital of 100 million yen or less is 34.59% in 2021.

Taxable year is the same as the company’s accounting period. A taxable year cannot exceed 12 months but can be less than 12 months.

The tax filing due date for corporate tax, business tax, inhabitant tax and consumption tax is within 2 months after the fiscal year-end, whether or not it has positive income for that fiscal year. If an application has been submitted, filing due date can be extended 1 to 4 months additionally (usually 1 month). Any tax due amount must be paid within 2 months after the fiscal year-end regardless of the extension of the filing due dates. In some cases, interim tax payment is also required.

Individuals

- Income tax (national tax) – if you are a salaried person, it is usually withheld from salaries

- Inhabitant tax (local tax) – if you are a salaried person, it is usually withheld from salaries. They are withheld from monthly salaries from June to May of the following year. If not withheld from salaries, payment is made in four installments per year.

- Consumption tax – if you are doing business as a sole proprietor and taxable sales are over 10,000,000 yen in 2 years’ ago

Individual income tax rate on ordinary income after deductions is taxed at progressive rate.

The tax table for individual income tax (national and local) on ordinary income in 2021 are as follows:

*In addition, special reconstruction income tax is imposed at 2.1% from 2013 to 2034 due to the post-earthquake reconstruction financing.

For example, with 7,000,000 yen of taxable income (income after various deductions), income tax is calculated as:

Income tax: 7,000,000 x 23% – 636,000 =974,000 yen

Inhabitant tax: 7,000,000 x 10% = 700,000 yen

In total: 1,674,000 yen

Tax rates for capital gains from sales of real estate and investment income can be taxed at different tax rate from the ordinary income. There is also withholding tax on investment income such as dividends, interests and capital gains on sales of listed shares. The tax rate is 20.315% (15.315% national tax +5% local tax) for dividends and capital gains of listed shares, and 20.42% national tax for dividends of non-listed shares.

The filing due date for individual income tax return is March 15th of the following year (During the Corona Disaster, the deadline was extended). The payment due date is also March 15th unless you applied for automatic withdrawal system. If you are salaried person with less than 20 million yen of gross salary, a company calculate your tax in December as a year-end adjustment, and you do not need any tax filing or payment by your-self unless you have other income besides salaries or you are in refund position.