Overview of Consumption Tax -Rules for the Consumption Tax Payers

In doing business in Japan, the consumption tax (Shohi-zei) might be the most familiar and often heard tax. The consumption tax is an indirect tax that levies a broad and fair tax on consumption in general, similar to VAT or GST.

In almost all the payments in Japan, you are paying the consumption tax of 10% or 8%. So, how about when you sell something in Japan? – should I add 10% or 8% consumption tax to the goods or service I sell to customers in Japan? Let’s briefly take a look at the general rules in the consumption tax.

Consumption Tax Payer

If you fall under the conditions for the consumption tax payers, you should add the 10% or 8% consumption tax on the goods or services you sell to customers in Japan.

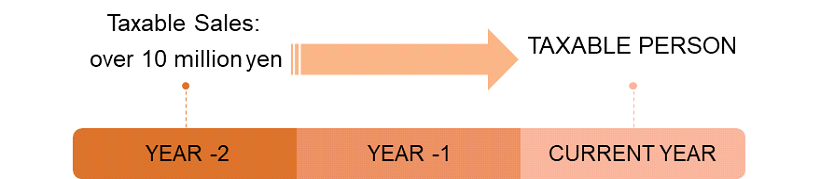

Principle Rule

Whether you are the consumption tax payer, in other words, if you are required to file the consumption tax return or not, you need to check the amount of domestic taxable sales and export exempt sales in the taxable year 2 years prior to the current fiscal year (hereunder called “base year”). If the taxable sales in the base year is over 10 million yen, you will need to file a consumption tax return for the current year.

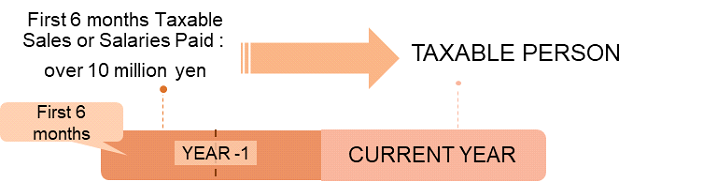

Exception Rule 1

Even if your base year’s taxable sales are 10 million yen or less, if the first 6 months of the previous fiscal year’ taxable sales exceed 10 million yen, you will also be a consumption tax payer for the current year.

Instead of taxable sales of 10 million yen, the total amount of salary and related payments of 10 million yen in the first 6 months can be used to judge the tax payer rule.

Exception Rule 2

If you expect to be refunded the consumption tax for a year, you can elect to be a consumption tax payer by filing an application prior to the beginning of the first taxable year for which it will apply. The election must be conducted with careful planning because it is generally irrevocable for 2 years.

Exception Rule 3 -for Newly Established Companies

For newly established companies, since there is no base year nor first 6 months of the previous fiscal year, they can be exempted from the consumption tax payers by the principle rule or the exception rule 1 for the first year and the second year.

However, there is a special rule for newly established companies. If you fall under either of the following tests, you will be a consumption tax payer for the first and second fiscal years.

- The company’s stated capital at the beginning of the fiscal year is 10 million yen or more

- The company meets both of the following:

- 50% or more of the company’s outstanding shares are held directly or indirectly by a person (individual or company) as of the beginning of the fiscal year

- The amount of taxable sales of that controlling person is over 500 million yen in the period corresponding to the theoretical base period of the newly established company.

In the case where a company’s fiscal year is the third year and its base year exists, the above Exception Rule 3 is no longer applied. If the base year is less than 12 months, the amount of taxable sales and export exempt sales need to be annualized.

There are a few more complex and detailed rules for the consumption tax payer.

Please consult your tax accountant for your actual business.