Invoice System

Basic Rule

The invoice system started on October 1, 2023.

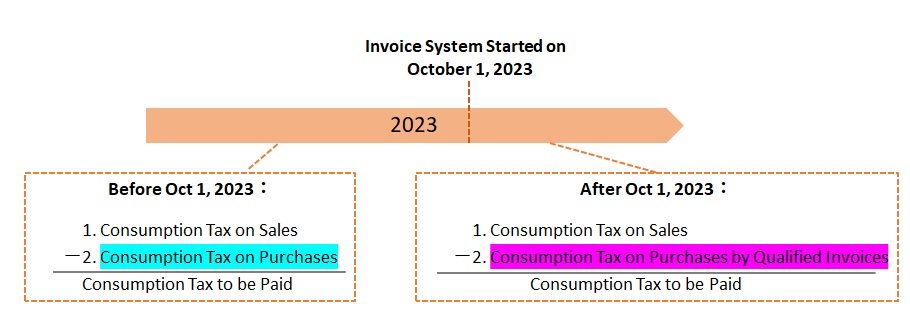

The basic rule of the computation of consumption tax to be paid by a taxpayer is

deducting the amount of consumption tax on purchases from the amount of consumption tax on sales.

However, from October 2023, tax credits for purchases can only be claimed for invoices issued by “qualified invoice issuing business” registered with the National Tax Agency (there is a transitional measure for a certain period of time as described below).

There have been cases in which exempted consumption tax payers (businesses with taxable sales of 10 million yen or less two years ago) have been required to register as “qualified invoicing issuing business” in order for their business partners to take credit for consumption tax on purchases.

If a company registers as a “qualified invoicing issuing business,” it will become a tax payer and will have to file a consumption tax return every year, which may increase administrative burdens and costs.

It is prohibited to unilaterally terminate a contract or reduce the price because the business partner is not a “qualified invoicing issuing business,” so it is important to negotiate with the other party before deciding on future transactions.

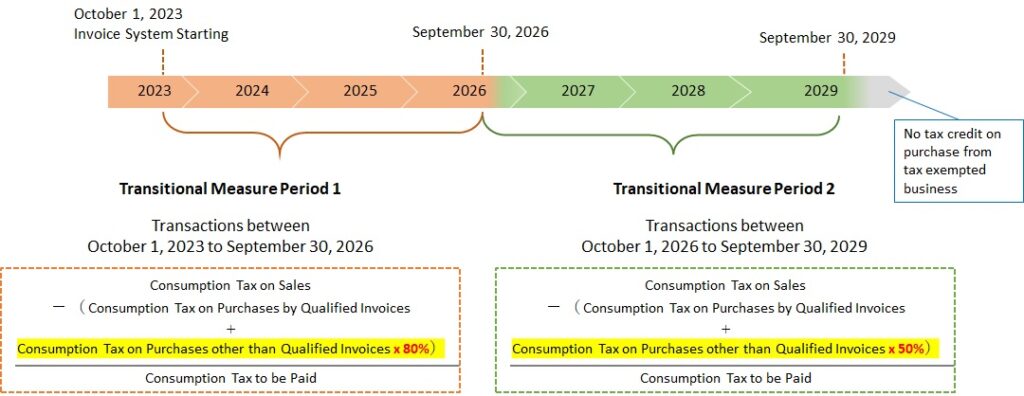

Transitional measures on credit for taxes on purchases

Even if the seller is a tax-exempt person, a partial credit for tax on purchases is allowed.

Consumption tax on purchases from a tax-exempt person is not deductible for transactions from October 1, 2029.

Transitional measures in the case of a tax-exempt person becoming a taxpayer

If a previously tax-exempt person becomes a qualified invoicing issuing business between October 1, 2023 and September 30, 2026, a transitional measure is provided whereby the amount of consumption tax to be paid is 20% of the amount of consumption tax on sales. In this case, consumption tax on purchase are not used to calculate the consumption tax to be paid.

Please note that this measure is not available for years in which taxable sales in the base period exceed 10 million yen.